Navigating the Investment Landscape: A Guide for Startups

THE FUNDRAISING PROCESS

Securing investment is a pivotal milestone for any growing business, but navigating the funding process can be complex. Whether you’re raising your first round or preparing for a later-stage investment, understanding how investors think, what they look for, and how to position your business is key to success.

This guide distills the core insights from a Scalare Partners investment masterclass, equipping you with the knowledge to confidently approach investors and secure the right funding for your business.

Inside, you’ll discover:

✔️The different types of investors and how to identify the right ones for your business

✔️What investors look for when evaluating startups and scaleups

✔️The stages of your funding cycle and where your business fits in

✔️Common valuation methods and how to assess your company’s worth

✔️The key contracts you’ll encounter in an investment deal

✔️How to prepare for due diligence and avoid common pitfalls

✔️How Scalare can help you succeed!

Raising capital is more than just securing funding - it’s about finding the right partners to fuel your growth.

With the right preparation and strategy, you can increase your chances of success and secure investment on terms that support your vision.

At Scalare, we specialise in guiding founders through this process, helping you prepare for investment with expert insights and tailored support. Let’s dive in!

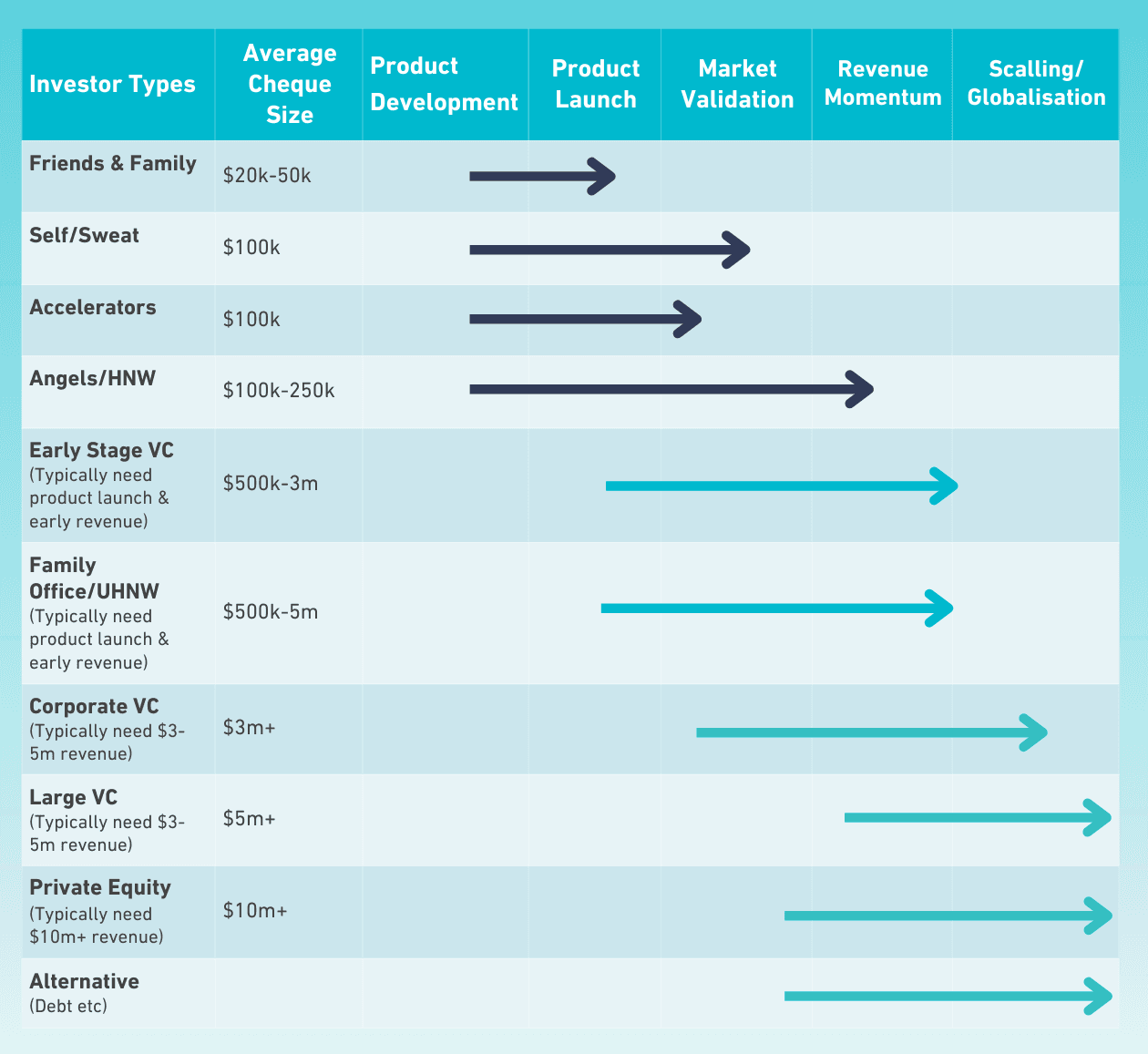

Investor Types - who to target?

Identifying the right investment partners at each stage of your startup’s growth is essential. As you move from the development and early launch phases to scaling your business, you’ll engage with different types of investors along the way. Knowing who to approach - and when - can save you valuable time and energy.

This chart outlines the key characteristics of various investor types, helping you identify the best fit based on how much capital you're raising and where you are in your business journey.

By targeting the right investors at the right time, you’ll maximise your chances of securing the funding you need to grow.

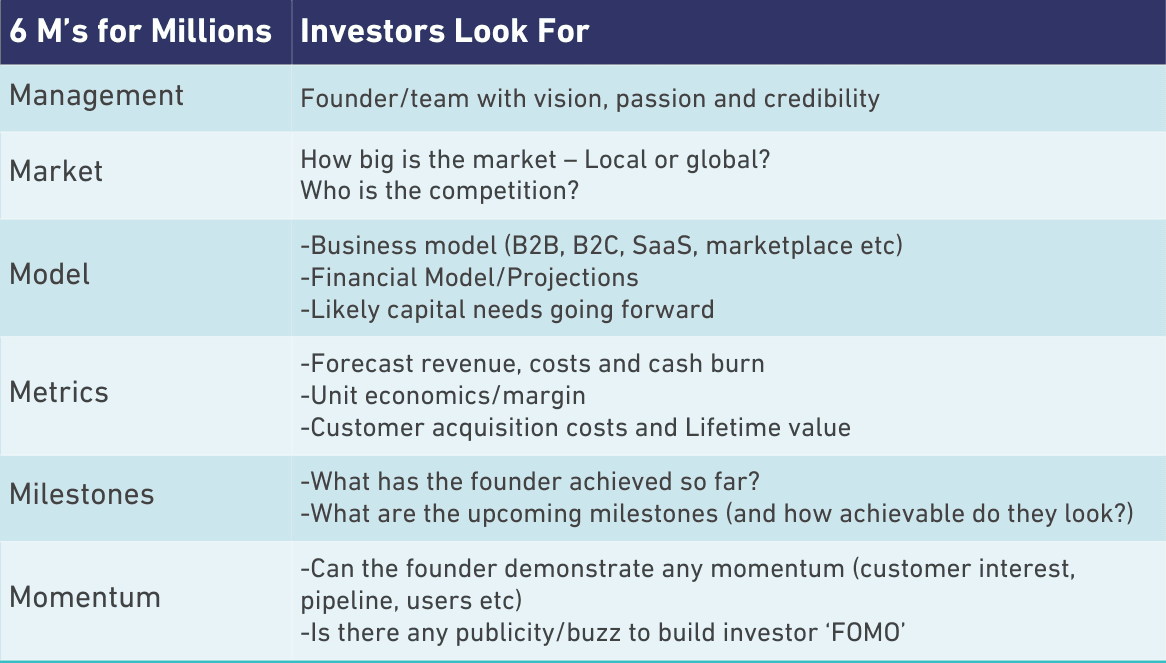

Things Investors Look For

Key factors many investors will evaluate opportunities on: Management, Market, Model, Metrics, Milestones, and Momentum.

A well-prepared pitch and pitch deck should address each of these areas clearly and confidently. While you may excel at explaining your technology and product, it’s equally important to navigate investment discussions with confidence. Be prepared to answer questions on your business model, go-to-market strategy, financials, and growth metrics.

Investors will ask tough questions, and knowing your numbers inside out builds credibility.

While covering all six is important, lean into your strengths. If you excel in a particular area, highlight it to showcase your competitive edge.

Preparation is key. By refining your pitch and practicing until you can speak effortlessly about these six factors, you’ll increase your chances of securing investment. Also, do your research on the investor you are meeting and the investments they have made, the investment mandate and things they typically look for,

So: research, rehearse, refine, and get ready to impress!

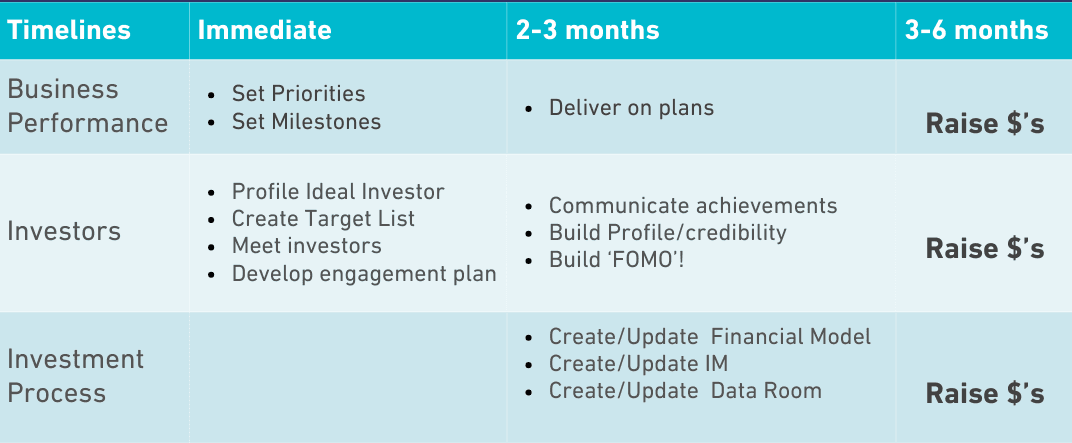

Funding Cycle - Actions & Priorities

Start early to support your raise later. This chart provides an overview of the funding cycle, helping you organise your efforts effectively.

TOP TIPS:

Assume your target investor has 2-3 other deals as attractive as yours so focus on how to set yourself apart:

✔️Be flexible and easy to deal with

✔️Move as quickly as possible (time is rarely your friend when raising money)

✔️Communicate any business wins/continued momentum

✔️Use your networks to work every angle and mutual connection

Navigating the Funding Cycle - Planning is Vital and Timing is Everything

Raising capital is a process that requires careful planning and strategic timing.

TIMING

Start preparing at least 3–6 months in advance to allow sufficient runway for securing investment.

BUILD RELATIONSHIPS

One of the most valuable steps you can take is to build relationships with investors long before you need to raise funds. Get to know your investment audience, engage them early, and make a strong impression before making your ask.

PERFECT YOUR PITCH

By refining your pitch and practising it, you’ll increase your chances of securing investment.

Our extensive experience in helping businesses raise capital has shown that the way founders approach this process directly impacts their success.

Those who plan ahead, engage investors early, and refine their pitch consistently raise more capital and secure better terms.

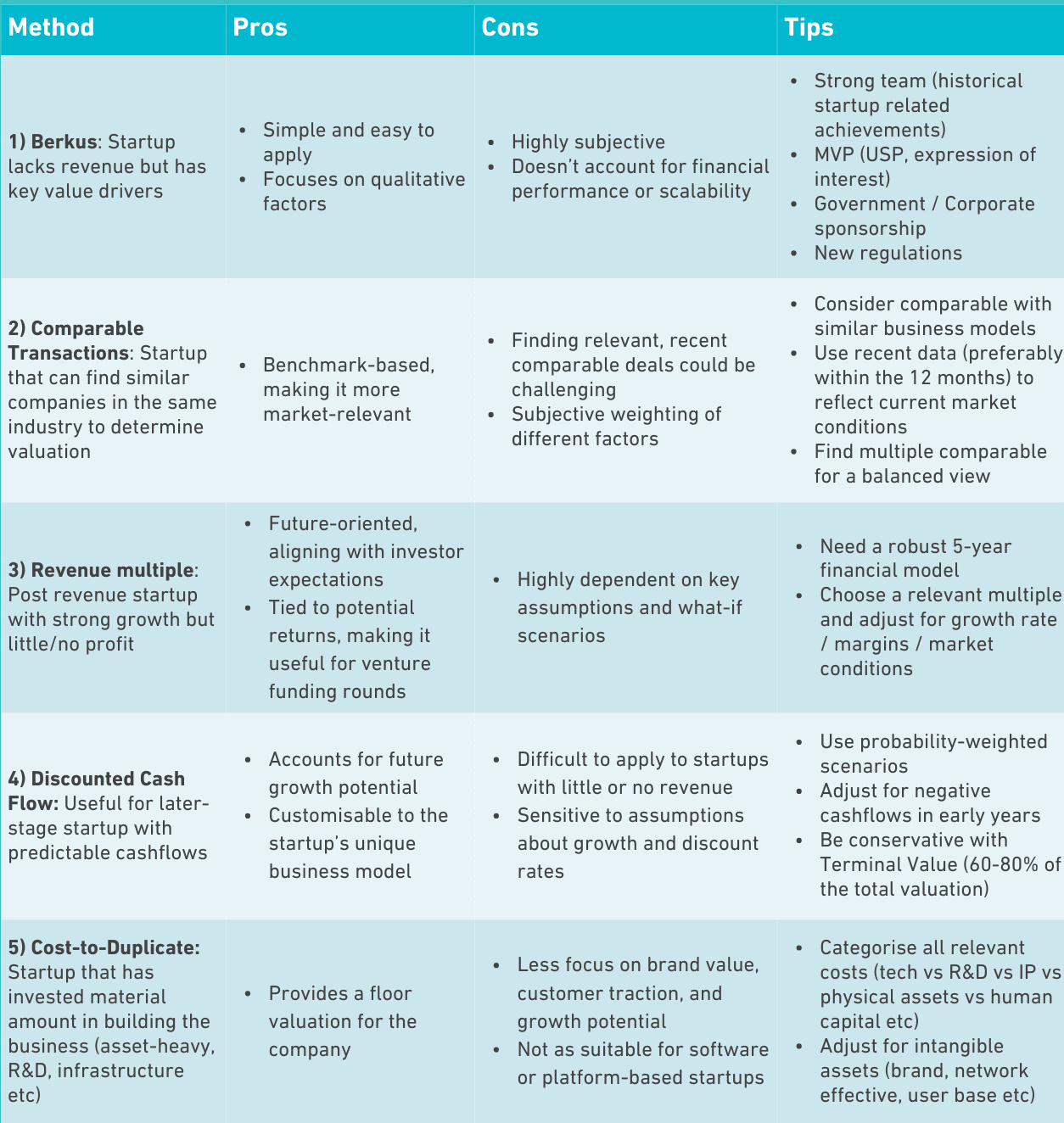

Valuation Methods

The Challenges - and Types of Approach

Valuing early-stage tech startups is challenging due to limited financial history and uncertain future. Investors often combine multiple approaches to get a more balanced valuation.

In Summary

Ask yourself: Which approach best fits my stage and investment partners?

Use the handy tips for how to present your business for each method!

Referring to the previous chart:

Early-Stage Methods (1 & 2) – Typically used for early stage companies with little revenue. Focus on market potential, business model, and scalability.

Combination Approach – Investors mix methods to balance strengths and limitations. Consider pros and cons carefully.

Growth-Stage Methods (3 & 4) – Suitable for businesses who are a little more mature and have a financial history. Ensure you have clear metrics and growth projections.

The Cost-To-Duplicate method (5) – Best for businesses that are more tangible and quantifiable for example hardware or biotech startups and those with physical assets, IP, or R&D investment. Investors factor in both tangible and intangible value.

Using the right mix of valuation methods will strengthen your investor conversations.

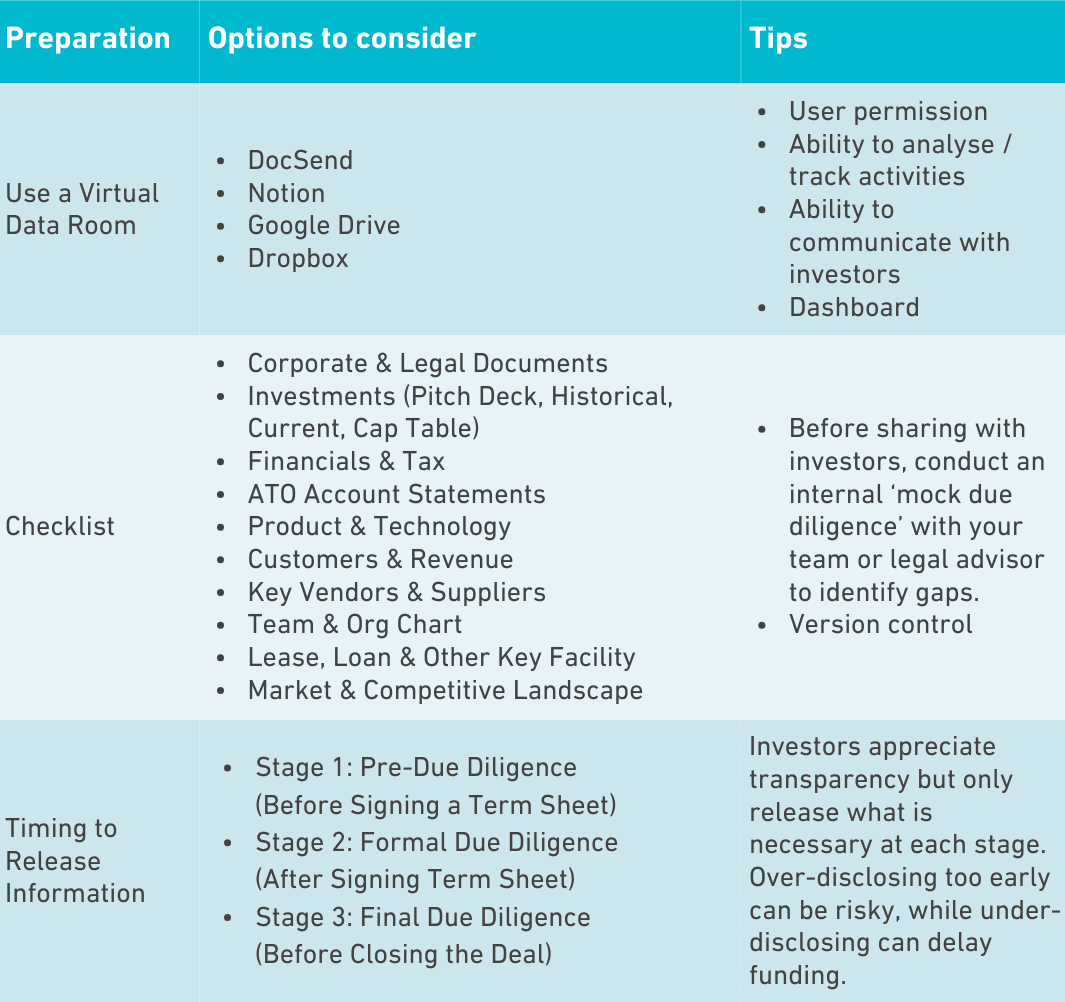

Due Diligence Preparation

Investors want to see a startup that’s well-prepared and organised.

A smooth due diligence process builds trust and speeds up funding decisions.

What Investors Expect

Due diligence is the verification process before finalising a term sheet.

Investors follow a checklist - make sure you have prepared thorougly and addressed any gaps.

Control information flow - don’t overwhelm investors by releasing everything at once.

Stage 1: Share only essential details to negotiate the term sheet

Stage 2: Once signed, provide checklist items as required

Stage 3: Hold back sensitive info (e.g. customer references) for final verification

Being strategic with your disclosures keeps the process smooth and strengthens your position.

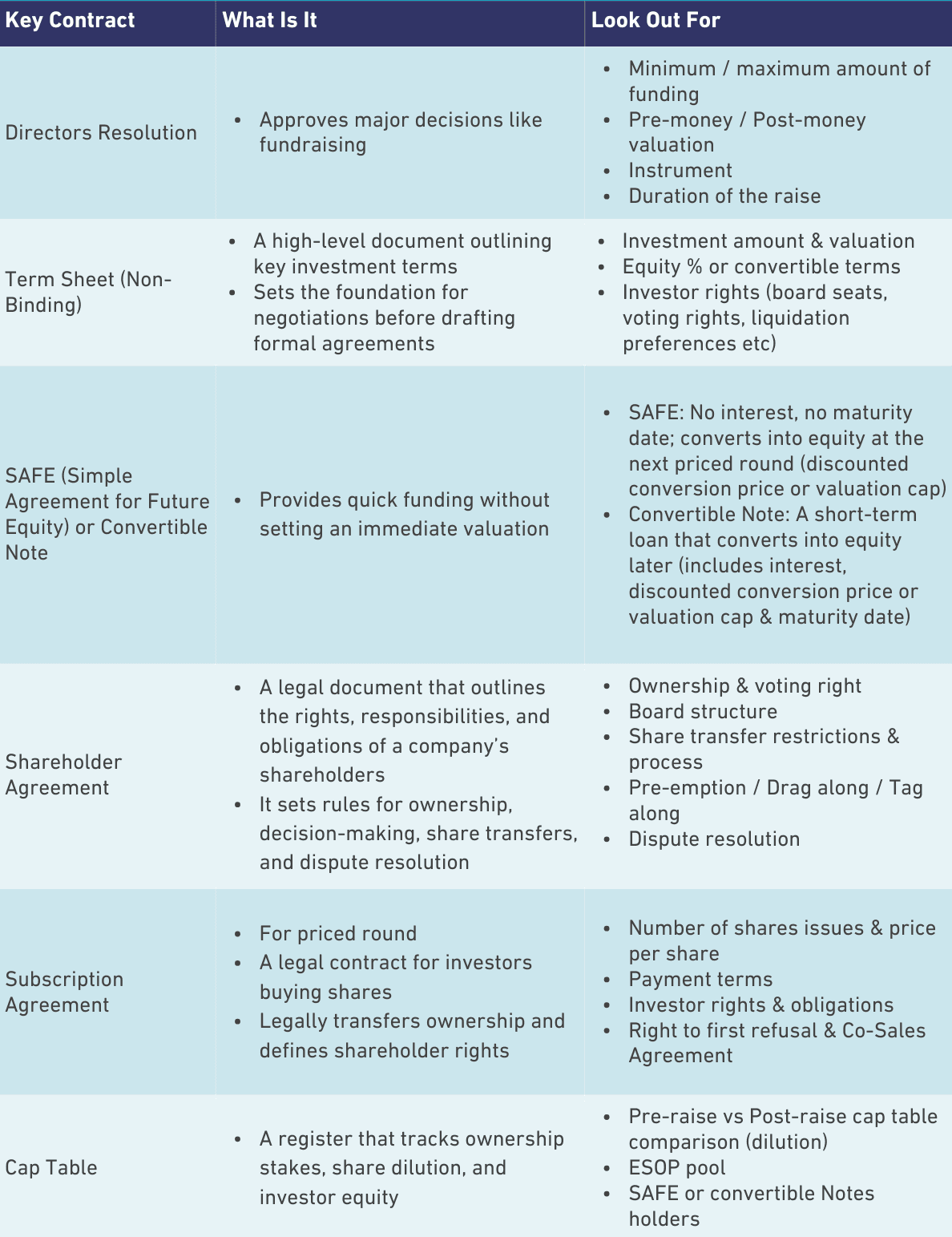

Key Contracts

Before signing any contract, ensure it’s thoroughly reviewed.

The following chart highlights key terms founders often encounter but may not fully understand.

These terms can have a significant impact on your business, and critical details are often buried in the fine print.

Reviewing these terms carefully is essential, especially in the final stages when signing investment documents.

How Scalare can help

Capital Raising Readiness: From financial modelling to due diligence, Scalare Partners excels in capital raising with a proven track record across diverse financial markets. Access a highly experienced team who understand the intricacies of fundraising to achieve your goals.

Check out the Tech Ready Women Investment Ready Program: An inclusive, accessible and supportive program, equipping women with the skills, network and confidence to raise capital and take their innovative businesses to the next level. Join here: https://www.techreadywomen.academy/investment-ready-program

Join the Inhouse Ventures Community: Inhouse Ventures helps create conversations that lead to faster growth for startups in 30 days. Join the IHV online community to build, scale and startup ecosystem: https://www.inhouseventures.com.au/

Looking for investment? Submit your pitch via the Scalare Partners website: www.scalarepartners.com

Proudly brought to you by: